Redesigning the Kuda Microfinance Bank Mobile Application Side hustle Bootcamp Cohort 5

Portfolio UI/UX Team.

Project Background

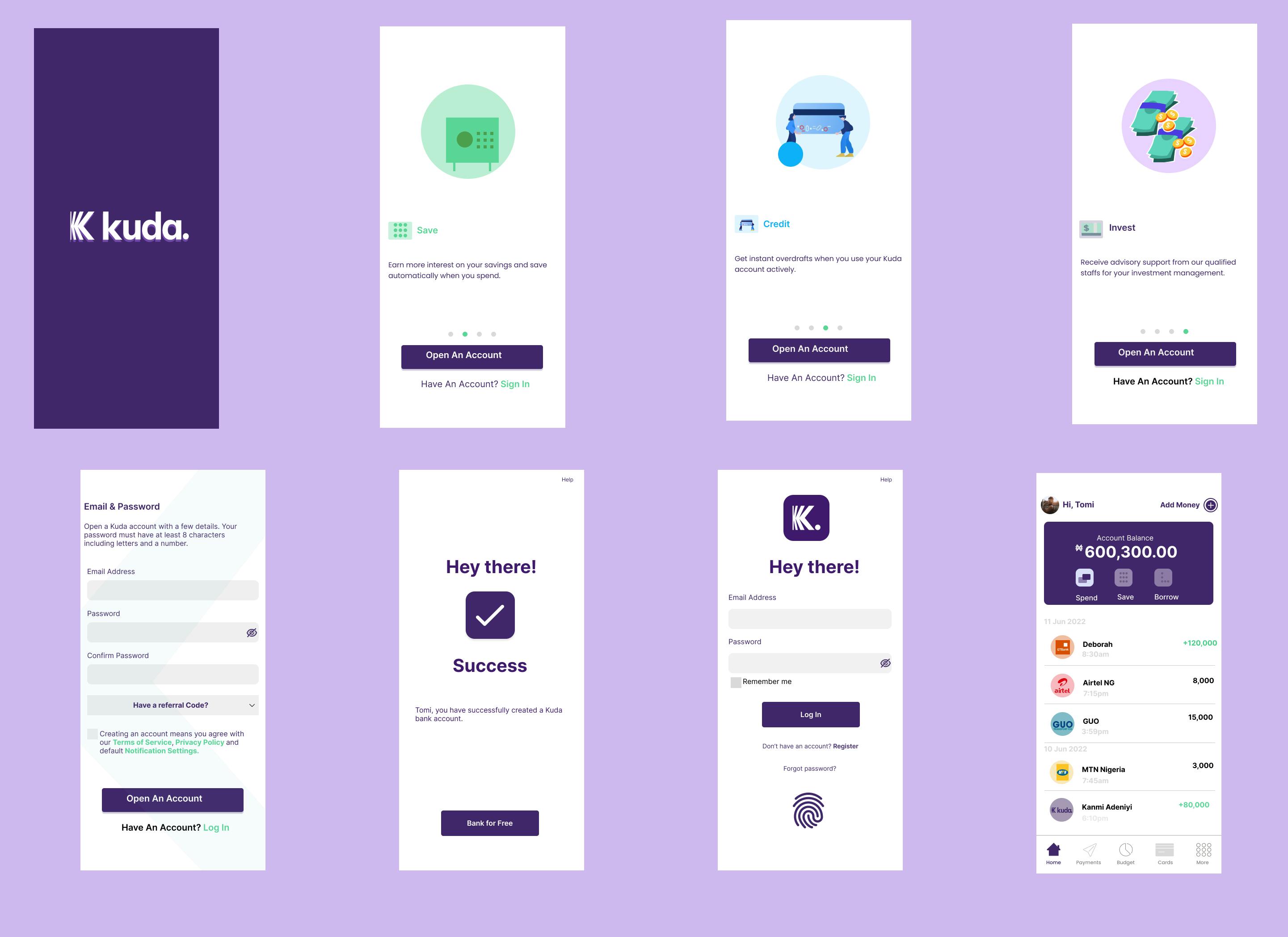

Fintech Apps are the holy grail of financial solutions and Kuda MFB, a Generation Z microfinance bank which is at the top of the list of financial institutions expertly mixing finance and technology together in Nigeria. In Nigeria, as well as all over the world, customer adoption of fintech is primarily driven by access and convenience, and trust is critical. A survey carried out in September 2020 by McKinsey & Company proves the statement above, as a 54% increase in the use of fintech was recorded over six months with the primary reason of access and convenience at 57% compared to value and price.

Listed as one of the top 10 players in the fintech space by Classified, Kuda Bank (formerly Kudi Money) is the subject of our user research. We set out to know why after 5 years of providing financial services, it was ranked as top 10 in May 2022. However, this survey was primarily focused on Kuda's mobile application, a platform that allows you to conduct transactions and payments with any internet-enabled smartphone. Firstly, we designed a questionnaire using google forms and distributed to Kuda's target audience in which majority are youths in Nigeria. This process was to understand the user's journey and the challenges encountered while using this app. Here are some of the questions asked:

Do you use the Kuda MFB mobile application? How often do you use the application? What are the challenges you face banking with Kuda? What would you like to be added to the app? How easy is it to use the Kuda app?

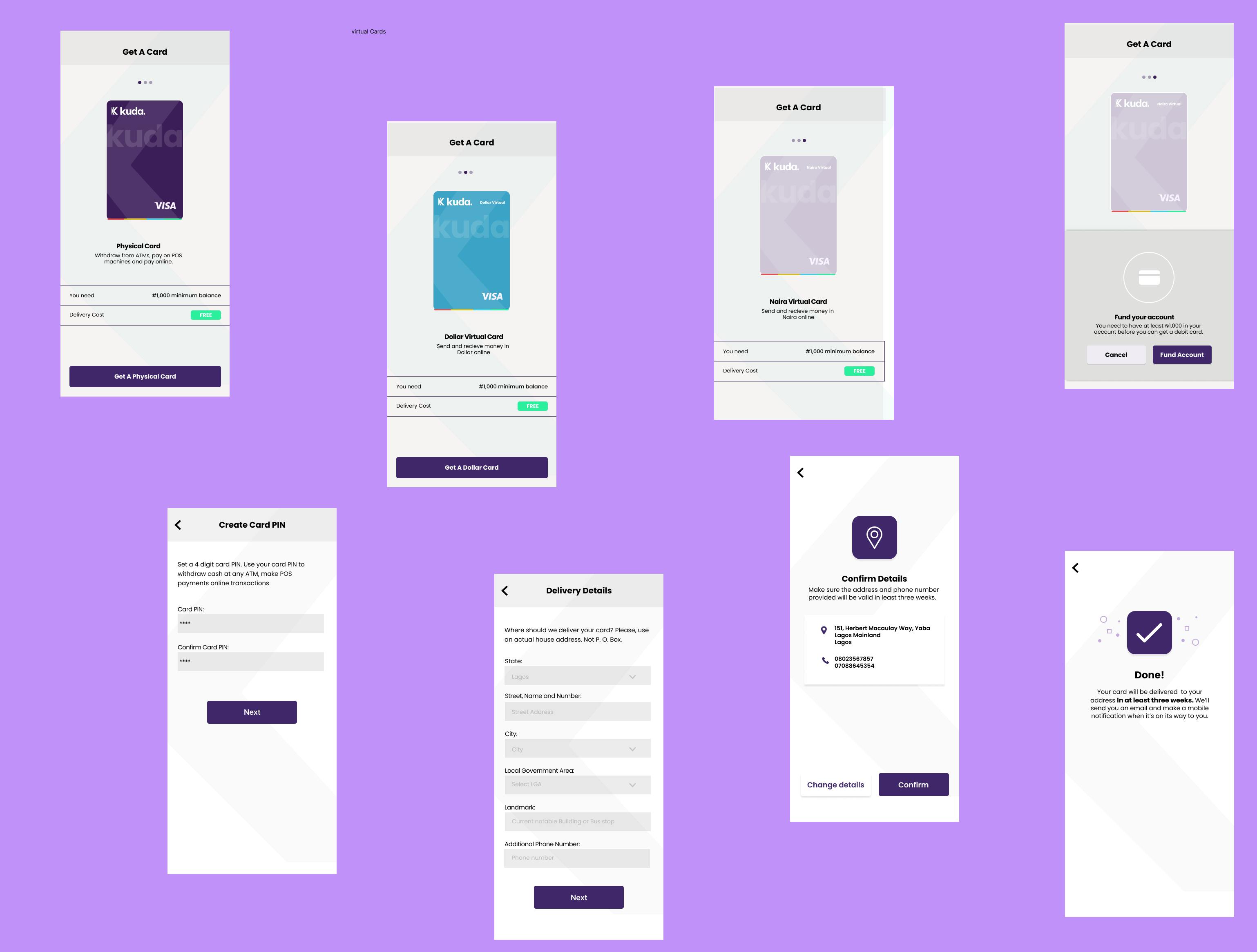

From these interviews, we were able to obtain insights and empathize with our respondents. Customers are generally impressed with the application but one major frustration includes late delivery of debit cards and poor customer service to make complaints in-app as Kuda has one physical office here in Lagos, Nigeria. Unlike traditional banks, this digital only bank allows customers to open accounts within minutes with no paper work. Transactions on the Kuda mobile app is also free for 25 transactions with zero naira ATM maintenance fee. It is so convenient that your Debit card is also delivered to you. Although, this is an innovative approach; selling ease and convenience, data gotten from our user research reveals that this is becoming a challenge for some of their customers. Several respondents stated that it takes several weeks and sometimes months before they receive their debit card, these users also mentioned that after reaching out to the customer service they still do not get the debit card on time. This made this team decide on adding a feature that allows customer know when their debit card will get to them. This feature will be in the form of an interactive progress tab that moves thereby allowing customers to track right on the app how long before they receive their debit card instead of waiting on a mail or having to contact the customer service. This will also reduce the workload of Kuda's customer service representatives and push back backlogs.

Another insight into this mobile app was that the Virtual Dollar card feature that would be a nice-to-have. Dollar cards saves us from the notorious exchange rate here in naira, where you can purchase items from international shops and pay in Dollar. A virtual card which acts the same as a physical card is fast becoming popular in the banking space, hence we decided to include it on the Kuda mobile app.

Conclusion

The first week of Side Hustle Bootcamp Cohort 5 took the team through fast learning, quick thinking and collaborative spirit and we hope as you follow us through this journey of six weeks and the rest of our lives, you would learn something too!

Till next week and next assignments!

Created by Oluwatobi Oyemade

Edited and Updated by Tomilola Adeleke